India is home to about 1 billion people and has a literacy rate of about 74% but unfortunately, only 24% are financially literate among them.

As per a survey, very few people feel “financially secure” in our country. 41.43 % of them have a pension as their main source of income, followed by interest on savings or earnings from property rents. In the next 20 years, the rate will increase if we do not educate ourselves today.

According to a CIC report, nearly half of our country’s working population is in debt. Until January 2021, 20 crore people have taken loans in some form. This means that people are paying thousands of interest on the loans which they have taken. There is an ardent need for an hour to understand money and become financially sound.

Now becoming financially independent does not mean earning more money and saving it. There are different ways to think about financial freedom – some might think not having to work, having no debt, being rich, having a path to retirement, or earning a high salary paycheck is a way to achieve financial freedom.

But does just earning more money make you rich?

Will more money really solve your problems?

The answer is definitely no. Along with earning a high income, you’ll need to horn the skill of managing money. Only then you can grow your money. Otherwise, you’ll remain caught up in the vicious loop of work, earning, and spending. In schools, we are not taught how to manage our expenses. Therefore we resort to our families for financial education where the children inherit the mindset of their parents about money. Thus poor get poorer, rich get richer.

This blog will discuss certain unorthodox steps on how you can attain financial freedom. So do give it a read till the end.

Have positive affirmations about money

You would have heard people saying that money is the root cause of evil, or it can’t buy happiness. Truth is money is important to fulfill your basic amenities. Even to own your roti, kapda, or makan you need money. It is baseless to think that you should not think about money. Rather have a positive outlook toward money. Be frugal but don’t have negative notions about money in your mind.

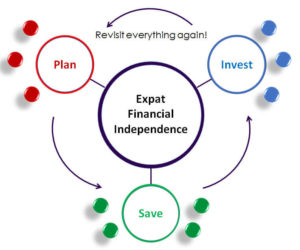

Plan a disciplined journey

Financial independence should be achieved with proper planning and not haphazardly or randomly. Learn to control your emotions. Never spend your hard-earned money in anger, frustration, or sadness. Plan your per day, month, or year’s expenditure beforehand. If you are an impulse buyer, have some buffer money, beyond which you won’t spend. This will help you increase your focus and also help you track your expenditure. In this way, you would be able to avoid impulse buying also.

Try to increase your income while keeping your cost of living the same. Always be self-aware of what you are doing. Your daily activities would decide upon your success. Lack of self-control, self-mastering, and getting distracted will make your investing journey a lot more arduous. You need to foster discipline in your everyday life.

Fix goals and ikigai behind money management as working towards a goal gives you a direction in life. Without goals, you keep running in a circle. Setting specific, realistic, and time-bound goals have proven to be the fastest way to gain financial independence.

Invest upon assets, not liabilities

Try spending less money on goods that increase your cost of living. Spending less doesn’t mean you spend a bare minimum lifestyle but rather have a smart way of living. Your spending amount should not be equal to your earning money. You need to invest a part of your earning money in a recurring format. Start investing in stocks, gold, real estate, etc. If you are confused about which investment plan suits you the most, try consulting the AMCs (Asset Management Company) to seek the best investment options.

Additionally, try to adopt smart choices in your life like learning to cook to save some pennies from ordering food daily from outside. Automate your payments so that you don’t end up paying late fees. Postpone your buying of non-essential products which leaves you with ample time to reflect upon your decisions and to think before you resort to impulsive purchasing.

Pay your debts as soon as possible. Try using the snowball method which is paying the lowest debt first and then the largest one as having debts can burden you with stress, anxiety, and overthinking. It is better to act early rather than repent.

Invest in yourself

As change is the only constant you need to constantly retrain, relearn and update yourself to keep up with this fast-paced world. Following are certain ways which will help you in up-skilling yourself.

- Explore and expand your knowledge base as much as you can by getting hands-on online courses like Google, Coursera, and Udemy.

- Try listening to audiobooks like Rich Dad Poor Dad, and the Psychology of Money.

- Read books on personal growth, time management, and money management.

- Engage with people out of your friend circle to increase your thinking horizon.

- Consult with financial experts to seek their advice to meet your financial as well as lifetime goals.

Have parallel income sources

Pandemics like corona have made people realize that one should not rely on one source of income. Try fueling your hobbies and turn them into an income-able side hustle. Adopt certain tweaks in your lifestyle to cut down your cost of living. Make money work for you while you are sleeping. Start investing. But avoid investing for the heck of it or in peer pressure. Educate yourself first before investing. Certain passive income options include being an affiliate marketer, investing in stocks, writing an e-book, or owning a business.

By having an alternate source of income, you can enjoy your life to the fullest fearlessly and explore various domains simultaneously.

Build a safety net around yourself before it gets too late

Instead of wasting your money on partying or mindless shopping, buy insurance and emergency funds for yourself and your family. And always keep some amount of money in a liquid form as you might face difficulty in liquidating your money in a time of exigency.

If you are still perplexed about investing, try contacting AMCs for the best financial advice. Avoid storing your money in your locker room as it starts decaying after a certain point of time due to inflation.

Lastly, you cannot achieve financial independence overnight, you need to trust your journey and stay patient. It’s high time that concepts like how to invest in gold, the fundamentals of a commodity, what is bond, and how companies go for IPO are incorporated into the school curriculum or incorporated in dinner table talks to reduce financial illiteracy.

Connect with expert financial planners at ANS Group.