Dealing with career downturns or recessions, deteriorated health conditions, unexpected transitions, natural disasters, or prone to accidents, every pandemic/ hardship period that became history still shows its effect on our financial health and teaches us only one lesson- Nothing stays permanent, be prepared for the unexpected.

Being financially stable and preparing for the worst are two different things when it comes to any financial crisis. So, to ride out the crisis now is the best time to emergency-proof your finances and lessen the overall disruption.

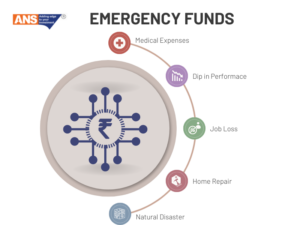

Unexpected Financial Contingencies that need preparation beforehand-

-

Unexpected Medical emergency-

Uncertainties will occur uninvited; the best example of this was the intense outburst that the COVID-19 pandemic has left behind in everyone’s life.

Earlier we used to learn about chronic conditions affecting elderly people. But the pandemic proved that no matter what your age is or how fit or healthy you feel, illness can affect your body and you need to get operated on under urgent medications and treatment.

Some medical emergencies arise suddenly and are disruptive and impetus the importance of being financially prepared beforehand.

This entire crisis requires a lot of funds to get treated and you can’t go a long way without a financial safety net in place.

-

A job loss or business downturn

“You’re fired”- the most horrifying word one can ever think of. Right?

Wait, you know what’s more dreadful- A Financial emergency occurring at such moments.

In the period of recession, Job losses got fairly ordinary, there’s no way to have an assurance of staying permanently in any job. Recently, you might be hearing a lot about companies cutting down on costs through employee layoff strategies (including the one that stayed at a higher position for a longer time).

It may take a few months to a one or two-year gap to upskill or re-skill yourself to be employable again.

Job loss or downturn in business can lead to disruption and distress in life, even if you’ve minimal lifestyle to maintain, as you’re obliged to manage the basic financial responsibilities of your family too.

-

Unplanned Life Transitions

Transitions can happen to you anytime; say the death of only one earning member in your family.

It’s more of an emotional turmoil in your family, but another wind that takes away everything & impacts your life the most is the way how you & your family members get financially affected at such moments.

Even sometimes the fulfillment of the basic requirement gets difficult with the loss of income – be it partial or total. It derails the financial situation and leads to setbacks in the goals & objectives you want to achieve.

-

Major property damages

There are several ways through which your personal properties can get severely affected like Natural calamities, accidents, and fire.

The cost of refurbishing your house may go up to a fortune of spending. Or if you meet with any major accident and your vehicle (bike or car) gets smashed or dented, you have to spend a lot to fix up the damage. You might have to think about buying a new vehicle in case of an unrepairable condition.

Other potential & unexpected damages can happen to other home appliances and all that can cost a pot of money from your income.

Tips on how to prepare for any unexpected financial crisis-

If you’re struggling with financial hardship, here are some steps you can take to help you get back in shape-

-

Start an emergency fund

In case you find yourself stuck with any financial crisis, you have to have at least 3-6 months of emergency funding worth of living expenses with yourself in the most liquid state or something that is easily accessible with minimum hassles.

Make sure that amount is used when an actual emergency occurs that seems to be shaking grounds and is negligible to manage like- Job loss, career transition, or medical expenses.

You can’t save all this overnight, so start to reserve your money through savings accounts, liquid debt funds, or small saving schemes with fixed returns.

-

Ensure adequate insurance coverage

When bills pile up or you feel trapped in any financial crisis, insurance policy coverage will act as a safeguard for you & your family’s future.

The best way to deal with financial emergencies is to get the right amount of coverage and shop for insurance policies with better payoffs. It helps you in eliminating unnecessary expenses by covering the deductible and copays.

- Health insurance- A Health insurance policy gives you a chance to lessen the havoc medical bills can create on your finances, by covering the major expensive medications and hospital treatment costs during an emergency.

Additionally, to be on the safer side, you should opt for purchasing a critical illness rider along with an insurance policy that can be proven beneficial during significant ailments of treatments like cancer.

- Car insurance– During any mishap if your car gets damaged, the car insurance policy covers the cost of complete repair.

- Homeowners insurance- Depending upon where you live, know what gets covered and the exclusions under home insurance policy like floods, fires, earthquakes, or any accidents that require the repair process.

Talk to your insurance partner about all the coverage you need under this policy, as a crisis arises unexpectedly and you’ve to be prepared to tackle the situation.

- Disability insurance- Some long-and short-term policies get covered under disability insurance when you are unable to generate monthly income due to disability or similar illness.

- Life insurance- Sudden demise of the earning member of the family creates havoc and turmoil in other family members’ lives, both emotionally and financially.

So, it’s crucial to protect your loved ones during such an arduous situation by opting for an adequate life insurance policy. This will be beneficial for your spouse, children, or parents.

The amount of value that policy covers should be enough that it can pay off your debts after you pass away.

- Umbrella policy- It provides coverage when all the other policies you hold fall short to deal with financial emergencies.

There are numerous streams to generate some extra cash during financial emergencies including- Selling unnecessary appliances/possessions you don’t use anymore, picking freelancing or part-time work, getting a second job, or mentoring & consulting individuals.

Become proficient in the in-demand skills that can add value to your career transition or begin your job search by determining sectors that are currently hiring.

The income you earn from these jobs might seem insubstantial to you at the start as compared to the income you use to earn in your primary job, but every penny counts when you’re under financial pressure.

-

Evaluate Expenses

Knowing how much and where to spend or save can help you to tackle unexpected emergencies. Review & identify the difference between essentials and extras that can let you know where you can cut off your expenses and save for future crises. These minute savings can make a big difference over time.

Being organized with your expenses and cutting down on what’s not a part of your necessities right now, can help you in paying bills when your money is tight.

Applying for personal loans during a financial emergency is considered one of the best options, as you can access your funds faster without giving up any collateral in return.

A few factors should be kept in mind while applying for a loan including- interest rates, hidden charges (if any), and eligibility criteria as per the institution you opt for funding loans.

The tenure to repay the loan is set based on the amount you borrowed and your financial situation and can be paid in form of EMIs. Plan to repay the amount as soon as possible to neglect the piles of interest charges.

Conclusion

Financial crises are so ordinary these days that they can appear in anyone’s life in any uncertain situation. You never know what’s stored in there for you, but it’s never too late to brush up on yourself for unforeseen conditions.

The best you can do is to start preparing yourself beforehand, keep track of your regular expenses, opt for multiple investment opportunities and savings, and prioritize every spending accordingly.

A Financial crisis like medical emergencies, job loss, natural disasters, or unplanned transitions can strike at any time, so depending on your attitude to work for them; it can either be a mere setback or the worst nightmare you’ve ever imagined.