“If you do not make money while you sleep, you will have to work until you die.” – Warren Buffett

As you approach retirement, you may feel like you’ve accumulated enough post-retirement corpora. Most retirees face the challenge of financial planning and fail to maintain their retirement savings, especially when life expectancy rapidly grows. It is also the stage when your earnings stop. Does this mean you should stop investing altogether?

Of course not! It is an excellent opportunity to employ investing to safeguard your assets, produce a monthly income, and grow your wealth.

A piece of advice for any senior individual is to consult an expert asset manager to help you find low-risk stocks and other safe investment choices.

Let us understand the top 5 investment plans for senior citizens to ensure a steady flow of income.

- Senior Citizen Saving Scheme (SCSS)

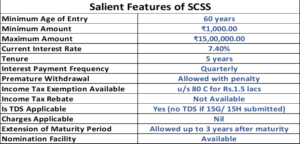

The first investment program making its spot on the list is SCSS. It is an Indian government-based investment scheme for elderly folks. The fundamental idea behind this investment choice is to provide a steady income source for a minimum of five years after retirement.

Who is Eligible?

Exclusively available to Indians aged 60 and beyond and provides the assurance of guaranteed income for the duration of the investment.

However, citizens who chose early retirement (VRS) at the age of 55-60 years or retired defense personnel in the age range of 50-60 years are also eligible.

What is the amount of investment and time duration?

The highest investment amount is Rs. 15 lakhs, whereas the lowest is Rs. 1000. It comprises a maximum term of 5 years and can be extended up to three years more. SCSS accounts can be prematurely canceled (or foreclosed) at any time, but at least one year must have passed after the account was opened.

- Post Office Monthly Income Scheme (POMIS)

The Monthly Income Scheme is mandated by the Ministry of Finance. This investment scheme is designed for older people to pay a set of monthly interest. It is a low-risk monthly income strategy that provides significant capital protection to protect the early retirement ages.

Let’s take a closer look at this Post Office Monthly Income Scheme:

What are the Eligibility Criteria?

This initiative is open to all Indian nationals aged 10 years and above.

Current Interest Rate: It currently provides an interest rate of 6.6% per annum, which changes quarterly.

Investment Amount: The minimum investment required to open an MIS account is Rs 1500. This is widely used in India’s smallest towns and villages. Furthermore, the maximum investment amount is Rs 4.5 lakh. Another option is to put Rs 9 lakh in a joint account. MIS allows for a monthly payment. This provides investors with a set and guaranteed monthly income.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY):

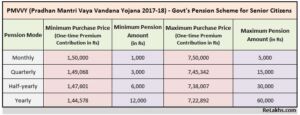

The PMVVY was generated in the year 2017 for the older section of society. LIC (Life Insurance Corporation) operates and manages it. This is a retirement-cumulative-pension plan that features an immediate allowance plan that guarantees a fixed payment to an investment regularly.

Let us now learn more about the Pradhan Mantri Vaya Vandana Yojana:

What are the variables of the scheme?

- Indian citizens who are 60 years and above are eligible to apply. There is no maximum age limit.

- The interest rates for the investment plan range from 8 to 8.3% annually. You can start with a minimum investment of 1.5 Lakhs INR.

- The term of the plan is 10 years. A person has the feasibility of choosing the option of an interval as per his/her retirement years.

- Senior Citizen Fixed Deposits

The Senior Citizen Fixed Deposit Scheme comes to the rescue by providing regular income to savers aged 60 and over. The amount of interest rate varies

Let us examine all of the scheme’s essential features:

- This versatile investment option is accessible to all citizens over 60 years. Even the NRIs can benefit from this program using their NRO/NRE accounts.

- The interest rate may change from one bank to another, on average, it can reach 7.9%.

- Investors can start a fixed deposit from as lowest as 10,000 INR (when applying through offline mode- by visiting a bank branch), or 5,000 (when applying online).

- Mutual Funds

When it comes to retirement most seniors want to safeguard their wealth while still generating a stable income, investment in mutual funds should be defined by moderate returns and low-risk capabilities. Debt, balanced, and liquid funds meet the requirements of senior citizen investing programs.

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”

Consult a trustworthy and reputed Asset Managing Company before investing in mutual funds:

- When choosing a mutual fund scheme, senior citizens should invest 70% – 75% of their cash in debt instruments and the remainder in stocks. This will guarantee that risk exposure is kept to a minimum.

- To play safe, choose a Debt mutual fund and take out the profit and invest in Equity oriented mutual funds. This will protect your assets from risk as well as generate high profits.

Final Thoughts:

We are in a rat race, and it is impossible to deny that we seek the thrill of triumph as we approach the final lap, which we call retirement. Everyone may not have set life objectives, but retirement goals are almost always set. We hope you have discovered at least one or two strategies to align your stars and be prepared to attain your retirement goals. So, at this age when you have access to limited investment options, it is imperative that you get the right guidance and the apt options because it’s about your hard-earned money. We understand that your lifetime capital would be at stake hence we make sure that your money is put in the right place and aids in your financial growth and building your wealth.

Contact us for a free investment consultation