Vacations are the best, right? A perfect way to lower stress, explore new places, relax, rejuvenate and find some rest in a stressful life. Vacations can be addictive for all the right reasons. Why should you not get a break from the stressful life every once in a while?

So, what is the ideal way to finance your exotic Maldives beach getaway or that super epic and historical trip to Western Europe? The most obvious answer is to borrow money and then pay it off in EMIs? Right? Wrong! What if we tell you that there is a better way to finance your trip than through EMIs which will only add to your stress later? Amazing right?

And that magical way is – SIP.

So, what should you do? Let’s take a look.

Financial stress

For instance, you planned a perfect family gateway on EMIs which costs around 1,00,000. You thoroughly enjoyed your trip and then your EMIs began. You start paying those EMIs through a credit card. You are charged a processing fee + other charges which go up to 1,80,000 to 1,90,000, imagine how much you will end up paying at the end of your trip.

Also, what if you have some issue back at your work for which you lose a job? How will you manage your livelihood and the debt? If you already have another ongoing debt like a car loan or home loan this will add to the financial burden and your stress too. So, a vacation that you took, in order to destress will end up stressing you more. So, it is clearly not a good choice.

Why is SIP a prudent choice to fund your vacation?

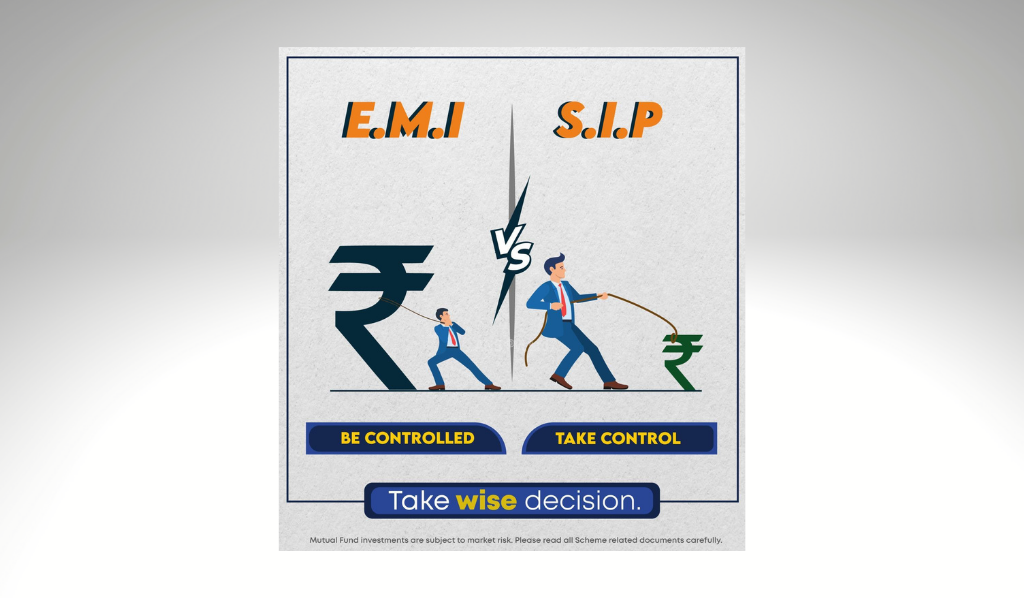

It’s simple. EMIs mean spend first-pay later. SIPs mean save and invest first and spend later. With SIP you can easily plan your annual vacations well in advance. And an even better advantage is that with EMIs you will be “paying” interest and thus your vacation ends up costing more, but with SIPs you earn “returns” thereby actually paying less from your pocket.

So, let’s see how planning an annual vacation through SIP will help destress in the right way.

- Choose your travel destination and estimate your travel budget including the travel cost, food, airfare or train or bus fare, etc. So, let’s say your perfect holiday will cost you around 1,00,000 including extra costs that you may encounter along the way.

- Now start planning your vacation through SIP well in advance. Find out how many months it will take to achieve your travel goals.

- Using an online SIP calculator will give you a better idea. SIP calculator is an online tool that brings you clarity on SIP-related decisions.

- Now that you have projected a monthly amount that will go towards your SIP you will plan your monthly budget accordingly. For instance, according to the SIP calculators you have to save 6,000 per month to be able to reach your goal of 1,00,000 including the returns. So save 6000 months on month for the desired period of time.

- Now, pat your back because you have achieved your desired goal by saving 6000 per month. When it is time… just encash your investments and enjoy your trip.

So, now you know which is the best choice to go on the perfect vacation, plan wisely. If you want any help we are just a call away!