I learned a long time ago that keeping a trade journal not only helped me to identify patterns that matched my personality, but also taught me how to avoid mistakes. The journal, with hard work and repetition, has allowed me to create a short-term entry strategy to improve the timing of capturing long-term styles.

One of my biggest weaknesses was getting into positions before the pressure became apparent. My favorite pattern requires the market to be in the consolidation phase for three to five days at very volatile prices and under-day ranges. This pattern often results in an outflow that extends approximately twice the length of a day or more.

The entry signal for this trade requires patience. I used to guess which direction the market would take and I often put a position about midrange. I was then suspended because the direction was unclear. When the pressure became clear, my confidence was low because I had already lost and would miss out on the outgoing trade. So, I set out to create a signal to avoid the middle trade and put in when bulls or bears expressed dominance.

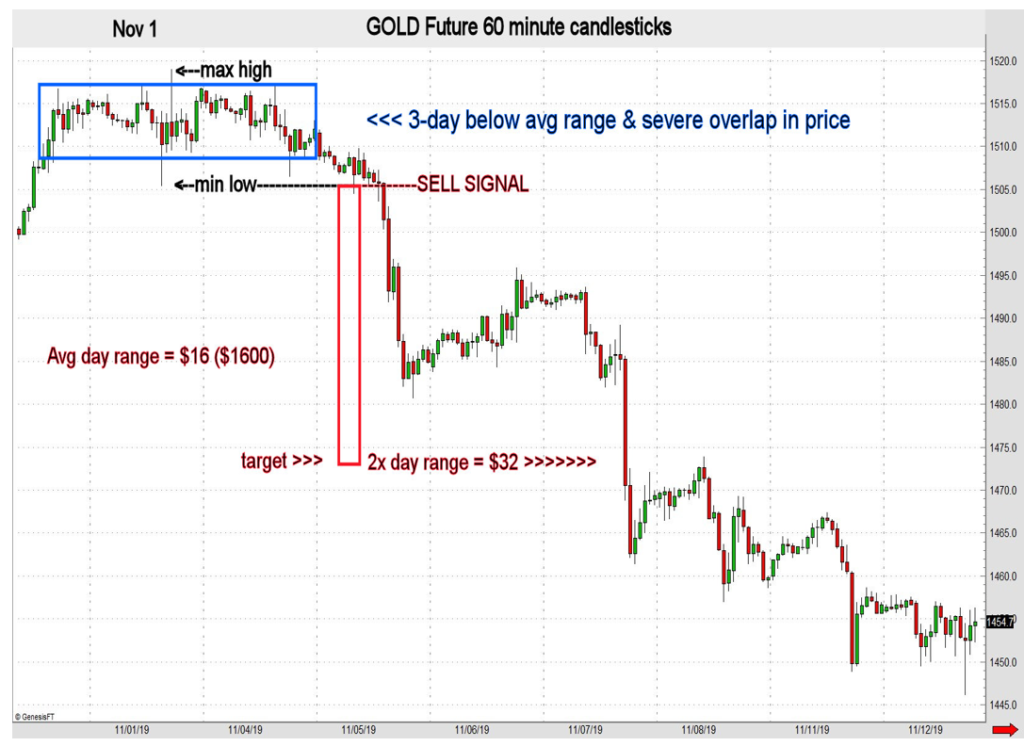

The gold chart below shows the ideal pattern and how to enter. It is called the highest and the lowest.

In this example, gold was in the merging mode of three sessions, then accelerated low after subtracting the minimum integration phase. A short position is taken when the minimum for three days is broken. In this way, it became clear that the merchants were the ones who had the greatest power. As shown in the graph, the target is doubled in the range of intermediate days or more. If the maximum height is violated, it will be placed in a long position.