Are you planning to start your investing journey with SIPs in Mutual funds?

Or are you the one looking for some great mutual funds to invest in but are puzzled and don’t know where to begin?

Don’t worry, continue reading this blog and you’ll surely get an answer to it.

Earlier people used to follow a systematic saving plan. They used to invest in FD (Fixed Deposit) because the return rates were higher back then. But now in this era of creating assets over liability, the return rates of fixed deposits are meager when compared to return rates of investing in stocks and mutual funds.

Gone are the days when people used to save their money in gulak. Now is the time to start putting your money in a recurring state and multiply it.

Especially if you are in your 20s then you must start investing. Even if you are in your 30s or 40s start growing your money now! Don’t be in a dilemma about whether to start investing or not. There is no correct age to start investing. The earlier you start the much better returns you’ll get. And in the case of mutual funds, the least amount required to start investing in SIP is just as small as Rs500/ month.

As quoted by Carlos Slim, “Anyone who is not investing now is missing a tremendous opportunity”

So better start today and speed up the growth of your money!

Everybody has heard about having SIPs and their advantages. SIPs are Systematic Investment Plans in mutual funds. And if you are a person who wants a hassle-free investment and want to earn a good amount of return without taking much risk, then you must try SIPs in Mutual Funds. It will serve as a vehicle to achieve your long-term goals.

Now the question arises: Why invest in SIPs?

Compounding – “Little disciplines compound over time make a huge difference”

–Albert Einstein.

The magic of compounding is visible in every sphere of our life be it relationships, learning, or investments.

Consider the following example to get a better hang of the power of compounding.

Vinay, a 20-year-old student began investing through SIP just by putting a meager amount of Rs.500 dedicatedly every month. He decided to increase his investment money by 10% every year, i.e. if he invested Rs.500 in his first year, he would invest Rs 550 regularly the next year. So in the next 20 years, he’ll make 13 lakh rupees. In 30 years his money will grow upto 75 lakhs. Within the span of 40 years, the same money will touch a whopping Rs 3.5 Crores.

Whereas Vignesh on other hand enjoyed his 20s partying and spending a lump sum amount on luxurious goods. He started investing his money when he stepped into his 30s. Despite investing a higher amount of money he couldn’t attain higher returns than Vinay.

If you start investing patiently with a determined state of mind today, after a certain point of time it takes off and you start earning money like you never imagined before. You can also earn a crore in less than 2 years. That’s the power of compounding.

It is not the amount that is important. It is the consistency with which you invest as compounding is the rate of return on an increased base amount.

Better than Fixed Deposits –

Return rates of fixed deposits are lower (about 6-7%) than SIPs as it gets affected by inflation. In the case of SIPs, you don’t have to dig deep into the market analysis daily. Unlike FDs, you don’t need to wait for a long tenure before the withdrawal of money. You can withdraw your money any time you want.

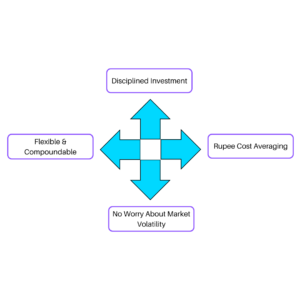

Disciplined investment-

Your money can be auto-debited from your account, once your investment term and frequency are decided. Money gets deducted from your account yearly, monthly, or quarterly- as per the standing instruction given to your bank account. This inculcates the habit of discipline in your investment journey.

Flexibility-

You have full liberty to reduce, increase or even stop investing your money if you are facing any financial crunch. This serves as a boon during the times like Covid when people tend to experience salary cuts.

Need not worry about Market Volatility-

Any kind of market- bearish or bullish, you don’t have to panic in any of them as it does not affect SIP.

Rupee cost averaging-

If your NAV (Net Asset Value) for the first month is 100, and 80 for the second month so total sums up to180, and by averaging, it comes out to be 90 which is lesser than the stocks you bought when the market was high. Less red marks on your portfolio anyway make you feel less panicky!

But wondering how it’ll be beneficial for you?

SIPs are like having a rasgulla bite by bite and enjoying every bit of it. SIP gives you incredible returns in a falling market.

And if you wish to invest lump sum money then invest that money in debt mutual funds wherein you’ll receive a fixed rate of return which will surely be greater than FD. Lump-sum investing works excellent in a rising market and would fetch a long-term return. But you should be aware of the market trends before investing. It is always advisable to seek valuable inputs from financial experts of AMCs before starting building assets through investments.

How to invest in SIPs?

Prefer a plan which would have less expense ratio. The expense ratio is the total percentage of fund assets used for managing your funds. – For example, if ER is 1% then Rs.99 gets invested and Re.1 is taken for the management of funds. Otherwise consult AMCs like ANS, HDFC or SBI for their financial advice. They would guide you the right way to attain your lifetime dreams.

For how long should you invest your money in a mutual fund plan?

You should at least keep your money invested for 5 years. If you withdraw your money before 1 year you would be levied 15% tax thus causing a huge loss especially if you are owning equity funds. This is because the exit load fee is charged to investors at the time of exiting fund units. If you invest your money for more than a year you would be considered under a long-term plan and only a 10% tax will be imposed.

How to pick the right SIP for you?

Select the type of mutual funds which suits your risk appetite. If you are a beginner, avoid going by anybody’s advice instead do thorough research about the market before finalizing the mutual fund in which you’ll be investing.

So what are you waiting for?

Stop spending your time mindlessly instead start investing your time to glean, grow and earn profits!